How to punt into copper producers like a muppet (Part II)(Reprise): Hudbay Minerals $HBM, Ero Copper $ERO, and Taseko Mines $TGB

In it for a long time, not for a good time.

Update 12/4/2024:

I had a suspicion in June that the buzz about copper was overdone, full of tourists, and due for some consolidation. My often-wrong instincts were pretty good on that call. Since June 26th, the copper price has gone from $4.36 to $4.14. Nothing about the long run thesis has changed, we still need heaps of copper, and there are not a lot of new mines coming along.

My conclusion from Part 1 was, if you are a tourist, hitch your wagon to the best capitalist in the space, and if you want torque, go for the small caps. If you had split between Ivanhoe Electric (IE) and Filo Mining (FLMMF), the Robert Friedland would have chopped wood sideways from $9.37 to $9.01, but the Lundin Family would have gone from $18.20 to $23.09 on the news of being acquired. Not terrible considering the underlying commodity price.

My conclusion from Part 2 was, if you don’t just want to hitch your wagon to the best capitalists in the space, and you want to choose your own small cap adventure, I would go 50/50 Hudbay Minerals (HBM) and Taseko Mines (TGB), but I wanted to pass on Ero Copper (ERO) for the time being. Since that writeup, HBM is up from $8.85 to $8.92, TGB is down from $2.51 to $2.05, and ERO is down from $21.42 to $15.31.

How to punt into copper producers like a muppet (Part II): Hudbay Minerals $HBM, Ero Copper $ERO, and Taseko Mines $TGB

Welcome back for Part II of punting into copper like a muppet.

ERO is likely getting punished for being Brazilian, meanwhile, gold and copper are international commodities, and should be unaffected by Brazilian Real weakness. They could be affected by communists in power, but I have a feeling that the modern communists are going to target industry less and target citizens more, which makes countries like Brazil buying opportunities rather than places to avoid. I could be wrong, but we can follow up on my toothless communists hypothesis in a couple of years.

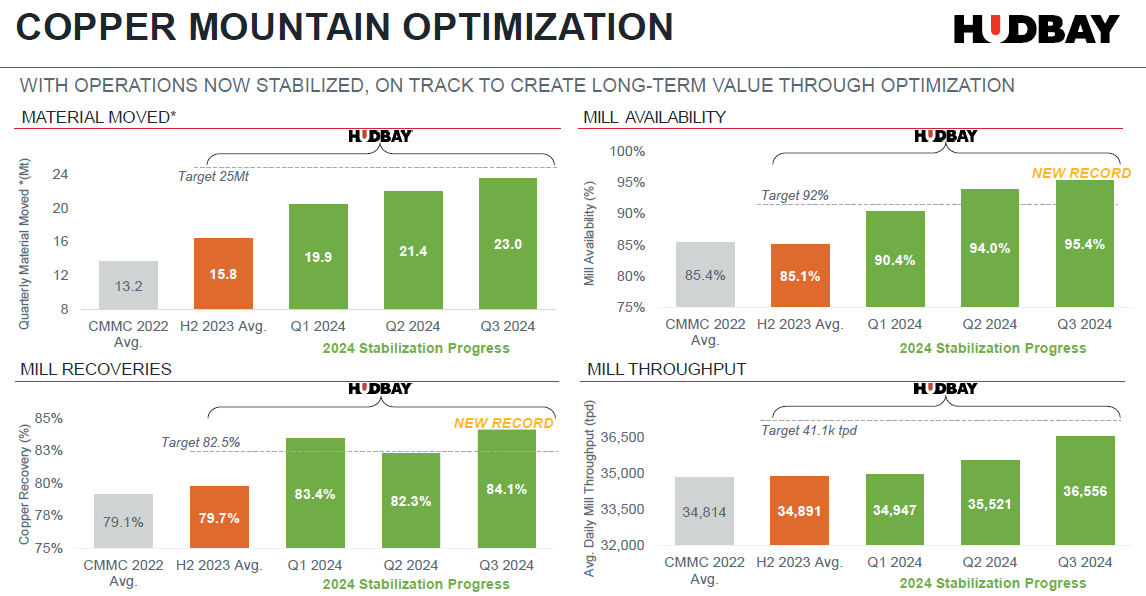

Hudbay Minerals (HBM) has continued to do what I thought they would do, professional management has been focusing on efficiencies, and doing it well. All in Sustaining Cost has fallen from $2.04 per pound of copper in Q3 2023 to $1.95 per pound of copper in Q3 2024. Earnings per share is flat over this time on lower output, and this $3.5 billion market cap company has delivered $840 million of EBITDA over the last 9 months, buying back $83 million of their own debt, paying down $130 million of their revolving credit facility, and repaying $83 million of gold prepayment facilities bringing leverage down significantly and doubling their cash reserves. As can be expected with professional management, good efficiency, but no return of capital to shareholders.

My primary reason for choosing HBM in the first place was their little gold mine mixed in with their copper mines. The Lalor mine in Snow Lake is currently producing 39% above nameplate capacity, with a permit in the works to expand, has a cash cost of $727 per ounce of gold, and produced 187,000 ounces in 2023, which at current gold prices would be over $300 million EBITDA annually.

The digestion of the Copper Mountain acquisition is going well, and should be at nameplate capacity by 2026, which at current copper prices should add another $180 million annual EBITDA to the approximately $600 million annual EBITDA from HBM’s Constancia mine in Peru.

And in the future, HBM plans to buildout their greenfield project Copper World, only when they have the balance sheet strength to implement it. Right now that would mean production start in 2029, and for the Mason Nevada project, production start sometime after 2030. Not exactly an aggressive growth story, but management is delivering on efficiency, with their 63 year-old CEO, who may or may not still be in charge by 2030.

HBM is hardly a degenerate choice, but when management keeps delivering the goods, I like to stick by management. Of course, without shareholder incentive alignment, those goods are plowed back into production, and not into shareholder’s pockets. But book value per share is up 7.5% in six months on a falling copper price, so not terrible. And 2026 EBITDA of around $1.3 billion on a $3.5 billion market capitalization isn’t bad for a completely consensus theme that should already be priced in.

Taseko Mines (TGB) is also humming along quietly, with $159 million operational cash flow in the first 9 months of 2024 on a $624 million market capitalization. That cash flow is getting plowed into the in-situ Florence Copper Project with the first planned copper production scheduled for Q4 of 2025. Management believes that when Florence is at full capacity, it should generate $300 million annual EBITDA at $4 copper, which when added to their Gibraltar mine’s $200 - $240 million annual EBITDA, would generate over $500 million in annual EBITDA by perhaps the end of 2026. Not bad for a $624 market capitalization company. Even at HBM’s multiples, should imply a $1.35 billion market capitalization by 2026, or a 47% annualized return over the two year period.

The biggest risk is whether or not the Florence Copper Project actually produces as projected, and in-situ copper mining isn’t new technology, it’s just that the geology where it works is quite rare. TGB also owns several undeveloped deposits, but the market doesn’t seem to value deposits which have no progress or timeline toward eventual production. Still, in any sort of a copper mania, those deposits could add to the share price.

Ero Copper (ERO) is in a similar state as TGB, generating operational cashflow, but plowing everything into growth capex. They are projecting about $180 million of EBITDA from copper and about $120 million of EBITDA from gold, but over $300 million of capex including exploration for 2024. As I stated in my original writeup, I prefer the buildout stage of mining over the exploration stage. However, the management team at ERO are good at exploration, and the stock price of ERO has plummeted enough to make it interesting here.

The Tucuma Project is projected to produce over 50,000 tons of copper in 2025, compared to 10,000 tons in 2024, so at $4 copper, 2025 EBITDA is likely to be about $160 million more than 2024 EBITDA. At current prices, you would be getting about $460 million of 2025 EBITDA for a $1.5 billion market capitalization, still slightly more expensive than HBM, even with the recent price crash. But, with the added lottery ticket character of the exploration results, and the odds of political risk decreasing in Brazil with the next election in October of 2026.

Conclusion: With the recent price action and the improved balance sheet, all three are more attractive today than they were six months ago, which is why I subtitled the original post, “In it for a long time, not for a good time.” But six months later, and at lower prices, now that nobody is talking about copper any more, I think all three are a reasonable buy here. TGB at $2.05 a share seems particularly enticing for copper, but both HBM and ERO have gold miners, and I love having extra gold in my copper. The inverse correlation between gold and copper due to monetary vs industrial uses should make a combined producer more valuable, but in small cap land those things rarely matter. If I take any profits on a position within the next few months (I’m looking at you Forward Air FWRD), I do plan on allocating more to these three names. The copper thesis is as ironclad as it ever was, few substitutes, increasing demand, and slowly responding supply. These names look good at $4 copper, but wouldn’t it be lovely to own enough to feel good about taking profits and trimming the position by half at $6 copper?

06/26/2024:

Welcome back for Part II of punting into copper like a muppet.

For a quick recap, the copper thesis is strong, but it’s anybody’s guess if the next leg in copper prices is up or down. If you want a small cap miner in the buildout phase, you can’t have it and ride on the coattails of Robert Friedland or the Lundin family, so it’s time to start turning over rocks. I usually look for small caps in the $500 million to $3 billion market capitalization space, but this is more of a guideline than a rule.

I started a position in Hudbay Minerals (HBM) back when the price was nearer to $5.50 a share, before their recent stock-based acquisition of Copper Mountain and before the stock price runup. Now they are sitting at about a $3.5 billion market cap, and after listening to earnings calls for the last 18 months, they have been consistently delivering operational success. HBM has two operating copper mines, one in Canada and one in Peru, as well as one gold mine in Canada. HBM also has three potential expansion projects, one each in Peru, Arizona and Nevada. None of the potential expansion projects could bring on new copper within the next 3-5 years, the only increase in output will be small and it will come from digesting the Copper Mountain acquisition and gaining efficiencies. One of the things that drew me to HBM at first was their gold output, gold and copper exist in the same ore bodies so copper miners always produce a bit of gold, but not all copper miners have 27% of revenue contribution from gold, and I predict much higher gold prices. You might ask, why not just buy a gold miner? Because I am using a Texas hedge for my gold thesis like a true degenerate.

HBM’s management team did not give me much encouragement initially, just one tiny insider buy from the CFO. I am always on the lookout for managerial bureaucrats with misaligned incentives, however, after following the company and listening to earnings calls for the last 18 months, the management team is delivering operational efficiency, and they are hitting their targets. Every once in a while a non-capitalist CEO does their job well operationally, but I would still be wary about capital allocation decisions given the lack of incentive alignment. Management has put together a three point plan with thresholds they need to cross before starting their next project, Copper World, and this indicates they may have some capital discipline.

Ero Copper (ERO) is a Brazil focused copper mining company with two producing mines, one copper and one gold, and a third mine expected to be producing copper in Q3 of 2024, potentially a catalyst, but probably already priced in. They have also announced an earn-in contract signed with Vale to acquire up to 60% of a copper exploration project, after funding the capex over a five year period. Those state enterprises are notorious for not spending enough on capex. I am concerned that the five year drilling project earn-in looks to need over $1.5 billion to fund, would devour all of ERO’s operating cash flow for the next five years and then some. This Vale earn-in expense seems a bit of a stretch for their current situation. I am not against earn-ins generally, that is one way in which Sibanye Stillwater (SBSW) has acquired assets and outperformed their peers over the last decade.

Brazil is in a unique situation, it is large enough to remain outside of the US or China’s sphere of influence and benefit from trade with both. This positions Brazil to have an amazing future for the next ten years at least. They did just elect socialist Lula to be their president, and we see him tinkering with Petrobras. But I believe that China’s influence on Brazil will be a stabilizing force, and Lula’s proclivities to ruin the economy will be restrained, the resources are too important to China. I could be wrong, and investing in Brazil is a unique risk which you may not want in your copper thesis. Brazil could also be a thesis that you want to embrace for the exposure.

The CEO of ERO, David Strang, is a capitalist, but almost strikes me as much of a mining flipper than a builder. He has been the CEO of four mining companies that were sold as well as president of a fifth. David Strang as well as the chief geologist and chairman were business partners who acquired ERO from previous owners in 2016. Since that time, production has grown from 20,000 tons annually to become 65,000 by the end of 2024 and 100,000 by the end of 2026. An incredible growth story, but with no other growth prospects on the near term horizon. All three have been selling heavily, and Strang’s ownership stake in ERO is down to 4% from 5% of the company, the others are down to 1.5% from 2.25% each just in the last couple of years. I have to wonder what their plans are for the future, they tout their exploration expertise, but I prefer builders over explorers.

Taseko Mines (TGB) is a North America focused copper miner with North America’s 4th largest open pit copper mine, Gibraltar, with about 20 years of life remaining on proven reserves, one mine build-out fully permitted in Arizona with the first ore predicted to come in late 2025, and three exploration projects in Canada, two copper and one niobium. They have only just finished consolidating ownership of the flagship mine Gibraltar, buying out minority interests. Gibraltar had been built in the 1970s and abandoned during a copper bear market, TGB acquired it in 1999 for $1, and restarted production in 2004. Since then it has been producing for the last twenty years.

After a 10 year acquisition, permitting, testing, and build out process, the Arizona mine build out is projected to generate 40,000 tons of copper a year at a unit cost $1.11 a pound starting late in Q4 2025, but not fully ramped up to the 40,000 ton run rate until full year 2027. TGB still has about $232 million left to spend on the buildout. Mitsui is funding $50 million of the buildout with an option to fund $50 million more which would give them a 10% stake in the Arizona project, implying a valuation for Arizona of $1 billion of which TGB would own 90%. Current market capitalization of TGB is $750 million. It’s kinda amazing how inefficient small caps can be at times even for punters who are late to the party. Without an increase in copper prices, there is a probability that within 2 to 3 years the stock price starts to price in this $900 million valuation gap.

Taseko is pioneering in-situ mining at their Arizona project, they pump solvent into the ground and pump out the dissolved metal. This practice is common already in uranium but it is less common in copper. How is a generalist supposed to yolo and underwrite the untested? I would have to rely on Mitsui who spent a year doing due diligence on the technology. Relying on the due diligence of others can fail as occurred for those who relied on Sequoia, Thoma Bravo, or Temasek who never uncovered the fact that Sam Bankman Fried ran his whole fraudulent empire with one spreadsheet and no segregated customer accounts. Caution is advised, but it’s not a deal-breaker for me.

The CEO, Stuart McDonald, is the least charismatic of the three; I mention this not to poke fun, but a particularly charismatic CEO can drive up the price of the stock before you buy it or after you buy it, so be careful. Robert Friedland was a friend of Steve Jobs in college, and according to Jobs’ 2011 biography, Friedland taught Jobs “a confounding melange of a charismatic rhetorical style, indomitable will, and eagerness to bend any fact to fit the purpose at hand.” I wouldn’t want to buy a stock already pumped up by that guy, but I wouldn’t mind him pumping it up after I already bought it.

Regarding choosing between the three, I compared management’s past statements about all in sustaining costs (AISC) of operations and compared them to current financial statements. What I found was that HBM’s projections were 89% accurate compared to ERO’s and TGB’s accuracy of 73% on their forward-looking projections. I am not implying that anybody was being a bad actor, it’s just that mining is difficult, problems arise, it’s hard to keep track of what has been allocated to royalty companies, and it’s better to underpromise and overdeliver. This reinforces my qualitative observations from earnings calls that HBM was being operated by an excellent team.

When I take future gross profit projections modified by my accuracy estimates and compare them with current enterprise values, I am cautiously confident in my analysis which puts HBM and ERO at almost exactly the same price: At $4/lb copper, current market cap is about 7x 2027 gross profit. At $5/lb copper current market cap is about 4.5x 2027 gross profit. And at $6/lb copper current market cap is about 3.5x 2027 gross profit. Only TGB stood as an outlier at a much cheaper price of 3x, 2x, and 1.5x 2027 gross profit at $4, $5, $6 copper respectively. That discount for TGB seems to reflect that their 2025 expansion project with novel technology is not priced in, while ERO’s 2024 expansion project is fully priced in.

So what’s the better choice between the three? If you are willing to outsource technological due diligence to Mitsui, and if TGB traded up to HBM and ERO’s multiples, then you are looking at a double from multiple rerating relative to peers independent of copper prices. And I am a value degen, so I gotta go with the cheapest. I almost always choose the capitalist over the manager, but HBM has really impressed me operationally for the last 18 months, and on top of that, I have a suspicion HBM’s CEO, Peter Kukielski, who managed 27 mines while the head of mining at ArcelorMittal, might be looking to expand inorganically. But he is 63, so how much longer will he be leading the company? In this case I would be 50/50 on TGB and HBM, and I am passing on ERO due to their preference for exploration over building, jurisdictional risk, and the heavy coordinated insider selling, which might be more of a reflection of temporary peak on copper prices than management’s potential desire to exit ERO. You might easily prefer ERO over the others if you love Brazil, love capitalists with skin in the game, and love mineral explorers over builders.

We won’t know which answer was the right one for several years. And if the right answer was just piggy-backing Robert Friedland and the Lundin family in their midcaps Ivanhoe Mines and Lundin Mining, I might fracture a few metacarpals in my hand from punching a wall.

“The struggle itself towards the heights is enough to fill a man’s heart. One must imagine Sisyphus happy.”- Albert Camus

I just became a founding member is it possible to chat by email